The payment capability index indicates the scale of risk in trade contacts with the assessed company. The method of calculating the Index was created by Creditreform in Germany in cooperation with specialists from finance and economics firms.

The payment capability index is calculated from a combination (mathematical algorithm) of 15 features presented in the credit report, and also based on values derived from comparative analysis of the industry. The assessment included in the payment capability index is presented as the three-digit number. The digits correspond to the rating system in use in Germany (from 1 = very good to 6 = insufficient). The second and third digits allow a more accurate diversity of our assessment.

Features affecting the Payment Capability Index:

- Payment menthod

- Credit evaluation

- Company development evaluation

- Order level

- Legal form

- Industry area

- Company's age

- Turnover

- Productivity (turnover per 1 employee)

- Number of employees

- Equity

- Capital turnover

- Payment habits of the company

- Payment habits of customers

- Shareholder structure

There are evaluated various elements affecting the payment credibility of a company. The evaluation of the order level is presented in a scale from very good (10) to poor (60), evaluation of company development from expansive (10) to insolvency (60). The same applies to the method of payment – from before agreed terms (1) to the lack of payment capability (6), as well as credit rating - from almost unattainable (1) to refuse of business connections (6). These and other features influence differently on the Payment Capability Index value. An important convenience for the reader is the presentation of key values near various paragraphs concerning the assessment.

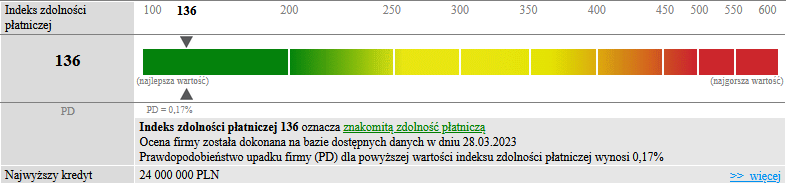

Probability of Default (PD) is a ratio of a statistical character which keeps the nature of probability in a mathematical sense, as it is calculated in accordance with the methodology defined by the calculus of probability as such. Probability of Default determines the likelihood of bankruptcy and/or the occurrence of massive payment delays over the next 12 months.

Calculation of PD takes place in a closed cycle, comprising the following steps:

- Defining the so-called Negative Events

- that is to determine what in fact will be treated as a "collapse" of a company. In the case of Creditreform Polska, the negative events for companies registered in the National Court Register are - court orders of bankruptcy, for the other companies - the so-called “massive payment delays" - meaning the company inability to pay their obligations.

- Selecting the parameters describing the company

- that is, those which have (bigger or smaller) impact on the occurrence of Negative Events.

- Determination of space parameter for

- that is to decide, how many and what values these parameters can take

- Scoring determination

- that is the determination of the scale illustrating the order of places in the parameter space and determination of the relation between the parameter value and the position on the scale (in case of Creditreform - the scale is the Payment Capability Index)

- Company evaluation

- that is, assigning each company the place on the scale (- a specific value of the Index)

- Registration of actual negative events (after a year from the evaluation)

- assigning to companies, in which occurred the Negative Events, information about this fact

- The statistical analysis of the entire database using the statistical discriminatory functions that allow to determine the impact of the Index (the position on the scale) on the probability of occurring the Negative Event ("collapse")

- The calculation of probability of default („PD”) on the basis of relations identified during the Analysis.

The methodology for determining PCI and PD is consistent with the recommendations of the document "Basel II" issued by the Basel Committee on Banking Supervision and directives of the European Parliament and European Council No 48/2006, 49/2006. Both Payment Capability Index and PD ratio are presented on the scale, which has a beneficial effect on the readability of both indicators and facilitates their interpretation.